By, Mitch and Cheryl Ekstrom

Half of all Boomers (and the upcoming Gen Xers) have done little-to-nothing to prepare for retirement. Many have given up on the hope of a reasonably comfortable retirement. Currently, around half of them begin taking Social Security at age 62. The current maximum Social Security benefit at age 62 is $2,209 (1) – or $26,508 per year. As an hourly wage, it would be $13.25. Nationally, boomers estimate their average annual cost of living in retirement at about $46,000 a year (2). If they have the Social Security benefit listed above, where will they get the $19,492 needed to close the gap to $46,000? Working? Maybe. But there are other steps you can take NOW for those who haven’t yet reached retirement age, and some ideas for everyone, even if they have.

Half of all Boomers (and the upcoming Gen Xers) have done little-to-nothing to prepare for retirement. Many have given up on the hope of a reasonably comfortable retirement. Currently, around half of them begin taking Social Security at age 62. The current maximum Social Security benefit at age 62 is $2,209 (1) – or $26,508 per year. As an hourly wage, it would be $13.25. Nationally, boomers estimate their average annual cost of living in retirement at about $46,000 a year (2). If they have the Social Security benefit listed above, where will they get the $19,492 needed to close the gap to $46,000? Working? Maybe. But there are other steps you can take NOW for those who haven’t yet reached retirement age, and some ideas for everyone, even if they have.

Imagine if a few small changes, just different choices immediately, could add $175,000.00 to the nest egg. Let’s take the example of a 50 year old couple who decide to get a plan to remove all debt and start saving the money they could by making just a few different decisions until they are 67. What if they invested the money for those 17 years, with a good portfolio of mutual funds. They would:

1. Stop Eating Out all the Time. The average person will save about $37.00 per week by eating in. Our couple has saved $295 per month. If they invest this at a very reasonable 7% annual growth until age 67, they will have built $116,239.00!

2. Buy Nice Used Cars instead of New Cars. Let’s have them stop buying new cars every three years. The average new car loses at least 20% of its value in the first year and 10%-15% per year over the next four years. (3) Let’s also say our couple was only buying inexpensive new cars at $25,000. Applying the lowest loss rate on inexpensive new cars, their car would lose $10,000 in value in three years. If they cut that depreciation in half, with a gently used car 2-3 year old car, they could save $5,000 every three years. The resulting $1,667 per year, if invested at 7% until age 67, would produce another $60,311.

Just these two changes, eating in more and driving used cars, would add $176,550.00 in savings to their nest egg.

Next, Paying Off Debt is the biggest step Boomers and Gen Xers need to take to save for retirement.

3. Lose the Credit Cards. The interest charged by credit cards averages 19.24%. (4) The average boomer carries $7,041 in credit card debt (5) So let’s get a solid plan to pay them off and invest the annual $1,354 saved on interest payments at 7% until age 67 — adding another $48,971. That is just the interest! Think of the monthly payments that are no longer owed!

Three steps, and they’re at $225,521.

4. Get Rid of the Mortgage. Today’s Boomers are carrying the greatest amount of mortgage debt into their retirement in the history of our country. (5) We have a few ways to save here. If our sample couple has a 7% rate on an average mortgage and refinance to 4.125%, their payments drop about $6,000 per year. If invested over 17 years at 7% they will add another $216,947 to their nest egg. That is just interest savings. We haven’t discussed paying the mortgage off, and investing that former payment!

So, four steps. Small decision changes that can add $442,468.00 in total!

Let’s assume they did all the investing in a traditional IRA and it didn’t grow from age 67 to age 70 1/2. Their required minimum distribution at age 70 1/2 on that amount is $16,697 ($442,468 / 26.5). (f) This amount added to the maximum Social Security payout at age 62, puts their annual income at $43,205 — just $2,795 away from their estimated $46,000 of annual expenses in retirement.

Imagine how much more they would close the gap if they got serious enough to give up $5 lattes, stops at the local pub, took staycations instead of vacations, eliminated unnecessary drives, did serious meal planning, operated only one car — and any number of other cost cutting measures. And paid off their mortgage.

Of course we haven’t spoken about the increased expenses that come with aging. But we also haven’t addressed the myriad of ways our couple could have increased income over these 17 years. So it seems there is money to be saved, earned and invested; and even if they make only half of the adjustments cited above, they’ll be way ahead of the, “…done little-to nothing- to prepare…”, crowd. The reality is that once you give your money to another person, both it and it’s time value are gone forever.

Difficult? Yes! But not compared to waiting! Each month of delay makes it tougher. And doing these things of their own accord is highly preferable to spending 20 to 30 years living in poverty or relying on children or charity or some combination of the three.

So it’s time to get smart about our spending, saving and investing. Let’s get our money back and put it’s time value to work for us instead of the lenders!

So get after it, Boomers (and the rest of us) and let’s do it now! You don’t have to be broke in retirement. If you need help putting a complete plan together to get started and/or make up for lost time, consider hiring a Ramsey Preferred Financial Coach. These hi-octane professionals are loaded with information, tools, training and strategies to help you.

Eliminate debt. Build wealth. Gain financial speed going uphill.

Mitch and Cheryl Ekstrom are Ramsey Preferred Coaches and Financial Peace University Coordinators. They lead financial wellness courses to help people of all generations get debt free and save for retirement. Mitch and Cheryl turned their own finances around 10 years ago and have witnessed first hand the financial knowledge now pass to five generations. They celebrated their 41st anniversary in December and their first great-grandbaby is on the way; due July 7th. Mitch spent more than 30 years of active duty in the U.S. Coast Guard and is now an IT professional on the largest financial system of its kind in the world. Cheryl manages money for the Physics Department at the University of Maryland. Prior to that, she managed multiple bank branches. They can be reached at:

Mitch and Cheryl Ekstrom, Dollar$ense, LLC, 301-466-7194, mecaekstrom@aim.com

(1) https://www.fool.com/retirement/2018/10/21/heres-the-maximum-social-security-benefit-in-2019.aspx

(2) Bureau of Labor Statistics as cited by https://finance.zacks.com/average-cost-retirement-4951.html

(3) https://www.finance101.com/new-cars-lose-value/

(4) https://wallethub.com/edu/cc/average-credit-card-interest-rate/50841/

(5) The Stanford Center on Longevity report, Seeing Our Way to Financial Security in the Age of Increased Longevity, points to an increase in mortgage debt among older homeowners as a concern, noting that in 2012, one-third of homeowners over 65 were still paying off a mortgage – up from less than a quarter of homeowners in 1998. And, the amount owed on a mortgage has nearly doubled from $44,000 to $82,000 (as cited in https://www.housingwire.com/articles/47364-stanford-boomersare-entering-retirement-with-less-savings-greater-mortgage-debt).

(6) https://www.irs.gov/publications/p590b

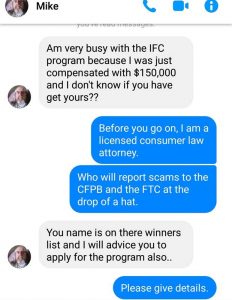

So, a Scammer DM’d a Consumer Law Attorney. Stop me if you’ve heard this one. It’s actually not funny at all, but it was for me, because I got the last laugh. Why? I immediately reported the attempted scammer to the Federal Trade Commission. I’m not alone, 1.4 Million people reported fraud to the FTC last year. Unfortunately, people also LOST $1.48 BILLION to fraud as well. People in their 20s made up of 43% of reporters, while people in their 70s made up only 15%. The median amount of loss to fraud last year was $400.00 for people in their 20s, and $751.00 for people in their 70s.

So, a Scammer DM’d a Consumer Law Attorney. Stop me if you’ve heard this one. It’s actually not funny at all, but it was for me, because I got the last laugh. Why? I immediately reported the attempted scammer to the Federal Trade Commission. I’m not alone, 1.4 Million people reported fraud to the FTC last year. Unfortunately, people also LOST $1.48 BILLION to fraud as well. People in their 20s made up of 43% of reporters, while people in their 70s made up only 15%. The median amount of loss to fraud last year was $400.00 for people in their 20s, and $751.00 for people in their 70s. 3. Fill out the form as completely as possible. If you receive a number, email, or even a social media conversation, please include that info. I took a screen shot of mine, so I had it to report.

3. Fill out the form as completely as possible. If you receive a number, email, or even a social media conversation, please include that info. I took a screen shot of mine, so I had it to report.

Half of all Boomers (and the upcoming Gen Xers) have done little-to-nothing to prepare for retirement. Many have given up on the hope of a reasonably comfortable retirement. Currently, around half of them begin taking Social Security at age 62. The current maximum Social Security benefit at age 62 is $2,209 (1) – or $26,508 per year. As an hourly wage, it would be $13.25. Nationally, boomers estimate their average annual cost of living in retirement at about $46,000 a year (2). If they have the Social Security benefit listed above, where will they get the $19,492 needed to close the gap to $46,000? Working? Maybe. But there are other steps you can take NOW for those who haven’t yet reached retirement age, and some ideas for everyone, even if they have.

Half of all Boomers (and the upcoming Gen Xers) have done little-to-nothing to prepare for retirement. Many have given up on the hope of a reasonably comfortable retirement. Currently, around half of them begin taking Social Security at age 62. The current maximum Social Security benefit at age 62 is $2,209 (1) – or $26,508 per year. As an hourly wage, it would be $13.25. Nationally, boomers estimate their average annual cost of living in retirement at about $46,000 a year (2). If they have the Social Security benefit listed above, where will they get the $19,492 needed to close the gap to $46,000? Working? Maybe. But there are other steps you can take NOW for those who haven’t yet reached retirement age, and some ideas for everyone, even if they have. flickr.com

flickr.com photo:credit.org

photo:credit.org

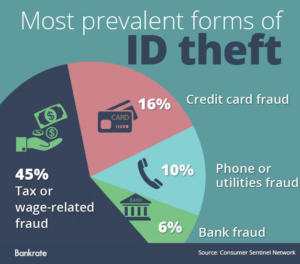

To make matters worse, in my humble opinion, the guardians of your credit report (and mysteriously calculated “score”) actually charge consumers hard earned dollars for access to their OWN information. The nerve! But my feelings aside, checking your credit report is an important part of taking control of your money. The Fair Credit Reporting Act, FCRA, authorizes one free credit report each year from each of the three credit reporting bureaus. There is only one link that is “federally certified” so do not click into any of the 34 ads on the way to

To make matters worse, in my humble opinion, the guardians of your credit report (and mysteriously calculated “score”) actually charge consumers hard earned dollars for access to their OWN information. The nerve! But my feelings aside, checking your credit report is an important part of taking control of your money. The Fair Credit Reporting Act, FCRA, authorizes one free credit report each year from each of the three credit reporting bureaus. There is only one link that is “federally certified” so do not click into any of the 34 ads on the way to