Lots of news floating around about how a new legislative proposal where the federal government would take 10% of a student’s wages as an automatic payment for student loans, basically a garnishment, and this may affect many of the current 44 Million borrowers. This suggestion has drawn fire from many consumer law advocates, like myself, who feel that this plan would allow the government to prioritize student loan debt above necessary living expenses; food, utilities, shelter, and transportation. But this proposal also has me thinking about the state of current student loan garnishment structure.

Lots of news floating around about how a new legislative proposal where the federal government would take 10% of a student’s wages as an automatic payment for student loans, basically a garnishment, and this may affect many of the current 44 Million borrowers. This suggestion has drawn fire from many consumer law advocates, like myself, who feel that this plan would allow the government to prioritize student loan debt above necessary living expenses; food, utilities, shelter, and transportation. But this proposal also has me thinking about the state of current student loan garnishment structure.

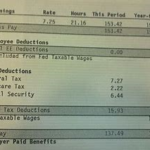

Garnishment is simply a “forced” withholding of part of a consumer’s income in response to a debt. Federal Student Loans are subject to “administrative wage garnishment” and will not need a court order if the borrower is in default. The current percentage of wages which is subject to administrative wage garnishment is 15% of a borrower’s “disposable income”, defined as the net check, or income after withholding taxes and other deductions. But this 15% is after mandatory minimum amounts that are protected from any garnishment. I will cover both consumers earning regular wages, and then consumers on fixed Social Security income.

Please note that PRIVATE student loans require a court order and a judgement against the borrower before the lender can garnish. Also note that the total amount of garnishment for debt allowed by law is 25% of the debtor’s wages… meaning, I am going to talk at the 15% rate in this article, but if the consumer already has a garnishment from somewhere else, the total garnishment cannot exceed 25%, so the federal student loan garnishment may be less than the full 15%.

For Consumers Earning Wages

The rule is 15% of wages after deductions, but what exactly does that mean? First of all, there are minimum amounts that are “exempt from levy” meaning, that amount cannot be touched for any reason by federal student loan garnishment. The current amount, as of this article, is 30 times the minimum wage after deductions. This means, at the current minimum wage, which is at $7.25 an hour (15 USC §1673), the consumer “keeps” the first $217.50 per week. That is the amount “exempted” from any garnishment calculation. The government can then take the LESSER of either the amount that is left after the $217.50, OR 15% of the consumer’s total income. It can be confusing, so a few examples are in order.

A. Consumer’s net income is $300.00 per week. After the exempted $217.50, the consumer has $82.50 left over. 15% of the $300.00 is $45.00. The government can take the LESSER amount, or $45.00 per week. In perspective, out of $1200.00 net income per month, the government can take $180.00. (This is why us student loan/ consumer law types want to do everything possible within the law to prevent garnishment for student loan delinquency.)

B. Consumer’s net income is $500.00 per week. After the exempted $217.50, the consumer has $282.50. But, 15% of $500 is $75.00, so the LESSER is $75.00 a week, or $300.00 per month. Another ouch. This is one reason that over a certain threshold, the calculation is almost always just 15% of disposable income.

One more thing, both Federal Pension and Private Retirement payments that are exempted from garnishment for debts in most states, is also subject to garnishment for delinquent student loans.

For Consumers on Social Security Retirement and Social Security Disability

Unfortunately, most of the time when I run into the “offset” (garnishment) of social security payments, it is because the consumer co-signed someone else’s student loan. If the borrower becomes permanently disabled, there are administrative actions that can be taken towards forgiveness of the federal loan debt. This is true for federal loans where the student passes away as well. But there are many cases where the Department of Education is offsetting Social Security Retirement Income (SSRI) and Social Security Disability Income (SSDI) payments. SSI, the program for the indigent, is exempted from “offset”.

Social Security Retirement and Disability are subject to an “offset” to recover federal debts since 2001 under the “Debt Collection Improvement Act of 1996.” The Department of Education can offset up to 15% (31 USC §3716). The amount offset is the LESSER of 1. The total amount of the debt 2. The amount that exceeds $750.00 per month, OR 3. 15% of the total benefit amount.

Here are the actual examples from the legislation:

Example 1:

A debtor receives a monthly benefit payment of $850. The amount that is offset is the lesser of $127.50 (15% of 850) or $100 (the amount by which $850 exceeds $750). In this example, $100 would be offset.

Example 2:

A debtor receives a monthly benefit of $1250. The amount that is offset is the lesser of $187.50 (15% of 1250) or $500 (the amount by which 1250 exceeds 750). In this example, the offset amount is $187.50 (assuming the debt is $187.50 or more).

If the recipient receives $750 or less, nothing will be offset.

(from: 31 C.F.R. § 285.4(e)(3)(i), 31 C.F.R. § 285.4(e)(3)(ii), & 31 C.F.R. § 285.4(e)(3)(iii))

Alternatives to Default, Garnishment or Offset

I have covered in previous articles how dangerous it is to a consumer’s financial future if they default on student loans. There are currently nine, that is right, NINE repayment options available through the Department of Education for student loans, and while nobody qualifies for all of them, many qualify for more than two. So PLEASE readers, know your options. Please do not let your student loans go 269 days past due. Call your servicer or a student loan attorney if you need help. If you have private student loans, the payment options may be limited. But contact the lender if there is a problem making your payment. As for the topic that inspired this article, legislation proposing the 10% monthly payment option. You can see how it would begin to prevent defaults, and the amount proposed is less than the current garnishment scheme. But then again, I believe consumers should control their income and not have to choose between food and federal debts. A garnishment is imposed because federal student loan notices were ignored, or nine total monthly payments were missed in a row.

Credit: nlipw.com

Credit: nlipw.com The Debt Management Service

The Debt Management Service