By Mitch and Cheryl Ekstrom

There’s a great deal of conversation swirling around the possibility of creating a big-government loan forgiveness program to end the student loan crisis. Call us cynical, but the current student loan crisis originated as a big-government program. But is it cynicism or is it experience? You decide – because there just already happens to be a big-government Public Service Loan Forgiveness (PSLF) program.

There’s a great deal of conversation swirling around the possibility of creating a big-government loan forgiveness program to end the student loan crisis. Call us cynical, but the current student loan crisis originated as a big-government program. But is it cynicism or is it experience? You decide – because there just already happens to be a big-government Public Service Loan Forgiveness (PSLF) program.

“Great!” you say. “How’s that working out?” you say.

Here’s where the experience part kicks in: “Terrible!” we say! Less than one-half of one-percent (0.005%) of all PSLF program applications have been approved. By the way, there have been over 41,000 applications and only 206 have had their loans forgiven!.

We’ve seen it in our coaching practice. One of our clients is an attorney for a non-profit who is 6 years into her 10 year loan forgiveness program. She has been hearing from peers who are a few years ahead of her that many of them are being rejected on technicalities. So big-government doesn’t mind messing with lawyers. Hmmm… that’s what we call a telling sign.

Between articles like the one above and our client’s experience, we generally recommend that people in PSLF programs be exceptionally attentive to meeting every detail of the repayment requirements. Servicers have misapplied payments or put people in forbearance “for a month or two”, meaning the borrowers do not have the required 120 “on time” payments”. But based on the actual numbers (the first PSLF borrowers were eligible for forgiveness in 2017!) people are taking a big risk in PSLF and they’d better have a plan B for paying it off – over years beyond the 10 years it takes to get to that supposed forgiveness point. However, that is a general recommendation for everyone in the program, the specifics must be personal to the circumstances surround the debt, the income, future increases in earnings, and other existing debts.

To get to a specific recommendation, we must assess the client’s overall financial situation, risk tolerance and goals. Below is a recent, real-world scenario in which we walked a client through two options for paying off their $106,000 of student loans, with the first payments starting this coming December. Everyone has a different scenario, and not everyone has this much student debt, but this illustrates HOW someone can reduce the risk of having student loans follow them around for the rest of their lives if the PSLF program goes away (and it could at any time).

Option 1:Starting in December, make 10 years of minimum monthly payments totaling $654 per month on each of 10 or 12 different student loans (they didn’t know exactly how many or what kind of loans, but they did know the minimum total payment) then hope against hope the remaining balance will be forgiven under the PSLF program. This is the option many people are counting on.

Option 2: Based on current income, projected income and all debt; pay off all non-mortgage debt, including their student loans, in 60 months and invest like they mean it the other 60.This is the option people in PSLF have a hard time with, but you’ll see the math- it’s the better option for long term finances!

Unpacking Option 1:

The 2018-2019 federal student loan interest rates are currently 5.05% for undergraduate loans, 6.60% for unsubsidized graduate loans and 7.60% for direct PLUS loans (2). Based on this, we used an average of 6.5% across their loans and derived the below calculations from this amortization schedule.

Using the June loan balance of $105,969 provided by the client, by the time they start paying on their loan 6.5% in December, it will have grown to $109,839.

In ten years of $654/mo. payments, they will pay $78,480 on the loan. And remember, Congress sets interest rates so it could easily change over 10 years. But let’s say it stays the same, and they pay the 120 payments at $654/mo. After all those payments, the balance on the loan will be $100,009. That’s right, people! $78,480 of payments over 10 years only reduced the loan amount by $9,830. But, they could have the $100,009 loan balance forgiven. THEY PAID $78,480! They just have to be one of the less than 0.005% who are approved. What could possibly go wrong!?

After all, let’s face it: $100,009 is a big windfall for the lender. So, one can see why they would be looking for ways to disqualify people. Might this contribute to why the terms and conditions of compliance with the numerous student loan agreements are really hard to understand and follow? But that’s probably just being cynical! So let’s just go ahead and assume they will have the loan balance forgiven without a hitch.

Unpacking Option 2:

Using this calculatorif they paid off the student loan in 5 years and invested the $654 per month at 12% (1); they would earn $53,946 over and above their student loan payoff. The faster you pay off those loans and the balances are reduces the loans are less subject to the interest they add.

However, there is another important piece of this client’s puzzle. They make a good salary and can pay off to pay off almost all of their other non-mortgage debt quickly, before the student loan payments start in December. The payments on that other debt alone is $1280 per month! Once those debts are gone, they free up that $1280 to add to the $654 minimum student loan payment. Their four wall budget won’t change, because the they’ve been paying debts every month with that money. Added together, they would throw $1934 per month at the student loans and pay them off in less than 65 months. And all of this math is before ANY of their soon-to-be-received significant pay raises this year (over $30K total); let alone any future pay raises over the five years (2).

Hypothetically, in the ten years they would make the large student loan payments, but only enough to pay it off in 60 months, but then invest their $1,934 for the next 60 months. They would have $159,529. In cash. In the same ten year span as someone waiting for the PSLF program to approve them.

So making minimum payments for 10 years while gambling on the long-shot of having the loan balance forgiven — instead of getting focused on paying off all debt in 5 years and investing the income they weren’t living on anyway because they were servicing all sorts of debt — while being exposed to multiple years of risk with way less cash reserves – is at least a $59,520 mistake.

Inevitable Math – 1

Servicing Debt – 0

But there’s one more factor which makes this early debt retirement and accelerated investment scenario even better: They have cut 5 years of financial risk out of their lives from a $100K+ loan hanging over their heads; a loan that can’t even be cleared by a bankruptcy! And, as frequently cited by one of America’s most trusted sources of financial wisdom, the nationally syndicated radio talk show host and multiple New York Times best-selling author, Dave Ramsey: In any 10-year period you have an 80% chance of experiencing a financial setback. So this risk factor is real and that makes it a big deal!

So, as you assess your own total debt load and options for getting your money back to work for you instead of the lenders, we hope this real-world scenarios helps. And if you want help assessing all the myriad details of your situation, consider contacting a Ramsey Preferred Coach. They are professionals with a mission to help you win with money.

(1) Based on the average return of the S&P 500 since its inception in 1926 of 11.69%.

(2) Given projected income increase, they could easily pay it off much faster than 60 months. But for the purposes of the illustration, we kept it to the more conservative 60 months of growth.

About the Authors:

Mitch and Cheryl Ekstrom celebrated their 41st anniversary in December and their first great-grandbaby is on the way; due July 7th. Mitch spent more than 30 years of active duty in the U.S. Coast Guard and is now an IT professional on the largest financial system of its kind in the world. Cheryl manages money for the Physics Department at the University of Maryland. Prior to that, she managed multiple bank branches. As a young couple, they made babies faster than money; so they borrowed — a ton of it — which led to real-world money struggles. But they have been living out, teaching and coaching the Financial Peace University (FPU) principles since Sep of 2009 and it has changed everything!

They have led 70 of Dave Ramsey’s classes — not just Financial Peace University — and have taught and coached over 850 couples, singles, teens, co-workers and family members. They’ve held classes in churches, at companies, on military installations, in Mitch’s office and in their home; sometimes three at a time. In addition, they have run numerous financial wellness seminars and budgeting workshops, given talks on money and relationship issues at marriage conferences, and delivered corporate training to reduce financial drama in the lives of the workforce — all by word of mouth. They’re happily so busy; they haven’t bothered to create a web-presence.

Closer to home, they’ve been blessed to see five generations of both their families achieve dramatic improvements in their finances and most every relationship in their lives. So no one can tell them this doesn’t work. It’s not a theory. They are multi-generational practitioners who are passionate about helping others experience the same strength and hope.

They can be reached at:

Mitch and Cheryl Ekstrom

Ramsey Preferred Coaches

Dollar$ense, LLC

301-466-7194

mecaekstrom@aim.com

DOLLAR$ENSE

Eliminate debt. Build wealth.

Gain financial speed going uphill.

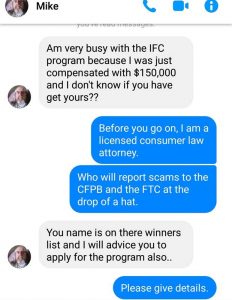

So, a Scammer DM’d a Consumer Law Attorney. Stop me if you’ve heard this one. It’s actually not funny at all, but it was for me, because I got the last laugh. Why? I immediately reported the attempted scammer to the Federal Trade Commission. I’m not alone, 1.4 Million people reported fraud to the FTC last year. Unfortunately, people also LOST $1.48 BILLION to fraud as well. People in their 20s made up of 43% of reporters, while people in their 70s made up only 15%. The median amount of loss to fraud last year was $400.00 for people in their 20s, and $751.00 for people in their 70s.

So, a Scammer DM’d a Consumer Law Attorney. Stop me if you’ve heard this one. It’s actually not funny at all, but it was for me, because I got the last laugh. Why? I immediately reported the attempted scammer to the Federal Trade Commission. I’m not alone, 1.4 Million people reported fraud to the FTC last year. Unfortunately, people also LOST $1.48 BILLION to fraud as well. People in their 20s made up of 43% of reporters, while people in their 70s made up only 15%. The median amount of loss to fraud last year was $400.00 for people in their 20s, and $751.00 for people in their 70s. 3. Fill out the form as completely as possible. If you receive a number, email, or even a social media conversation, please include that info. I took a screen shot of mine, so I had it to report.

3. Fill out the form as completely as possible. If you receive a number, email, or even a social media conversation, please include that info. I took a screen shot of mine, so I had it to report.

There’s a great deal of conversation swirling around the possibility of creating a big-government loan forgiveness program to end the student loan crisis. Call us cynical, but the current student loan crisis originated as a big-government program. But is it cynicism or is it experience? You decide – because there just already happens to be a big-government Public Service Loan Forgiveness (PSLF) program.

There’s a great deal of conversation swirling around the possibility of creating a big-government loan forgiveness program to end the student loan crisis. Call us cynical, but the current student loan crisis originated as a big-government program. But is it cynicism or is it experience? You decide – because there just already happens to be a big-government Public Service Loan Forgiveness (PSLF) program. I hope everyone is having an amazing summer! Can you believe July 4th has passed us already? Since we are now into July, I suspect that back to school ads and sales are coming soon. I need to let you know about a proposed rule that the Consumer Financial Protection Bureau (CFPB) released regarding debt collection.

I hope everyone is having an amazing summer! Can you believe July 4th has passed us already? Since we are now into July, I suspect that back to school ads and sales are coming soon. I need to let you know about a proposed rule that the Consumer Financial Protection Bureau (CFPB) released regarding debt collection. Half of all Boomers (and the upcoming Gen Xers) have done little-to-nothing to prepare for retirement. Many have given up on the hope of a reasonably comfortable retirement. Currently, around half of them begin taking Social Security at age 62. The current maximum Social Security benefit at age 62 is $2,209 (1) – or $26,508 per year. As an hourly wage, it would be $13.25. Nationally, boomers estimate their average annual cost of living in retirement at about $46,000 a year (2). If they have the Social Security benefit listed above, where will they get the $19,492 needed to close the gap to $46,000? Working? Maybe. But there are other steps you can take NOW for those who haven’t yet reached retirement age, and some ideas for everyone, even if they have.

Half of all Boomers (and the upcoming Gen Xers) have done little-to-nothing to prepare for retirement. Many have given up on the hope of a reasonably comfortable retirement. Currently, around half of them begin taking Social Security at age 62. The current maximum Social Security benefit at age 62 is $2,209 (1) – or $26,508 per year. As an hourly wage, it would be $13.25. Nationally, boomers estimate their average annual cost of living in retirement at about $46,000 a year (2). If they have the Social Security benefit listed above, where will they get the $19,492 needed to close the gap to $46,000? Working? Maybe. But there are other steps you can take NOW for those who haven’t yet reached retirement age, and some ideas for everyone, even if they have. I had the amazing privilege to attend the Consumer Assembly last week in Washington DC, and there was a panel discussion on credit scoring. The panel was actually a discussion on a group of American consumers that are dubbed by the industry the, “Credit Invisibles.” These are people who cannot get a “good” credit score in the typical way, by having open lines of credit that are at least six months old. The industry that scores credit, including the Fair Isaac Corporation (FICO), the developers of the FICO credit scoring models, and Vantage Score Solutions, LLC, the developers of the Vantage credit scoring models, feel that “credit invisibles” are disadvantaged in receiving access to credit products. And they are, but this new model by FICO to address the credit invisibles and those with marginal credit is not good for consumers.

I had the amazing privilege to attend the Consumer Assembly last week in Washington DC, and there was a panel discussion on credit scoring. The panel was actually a discussion on a group of American consumers that are dubbed by the industry the, “Credit Invisibles.” These are people who cannot get a “good” credit score in the typical way, by having open lines of credit that are at least six months old. The industry that scores credit, including the Fair Isaac Corporation (FICO), the developers of the FICO credit scoring models, and Vantage Score Solutions, LLC, the developers of the Vantage credit scoring models, feel that “credit invisibles” are disadvantaged in receiving access to credit products. And they are, but this new model by FICO to address the credit invisibles and those with marginal credit is not good for consumers.